Imagine working hard for years, investing your savings into what seemed like a lucrative opportunity, only to find out that you have become an unwitting conspirator in a Ponzi scheme. Ponzi schemes are deceptive investment crimes that promise high returns , e.g. conservation easements or other high yield investments. If you find yourself caught up in such a scheme, it is crucial to seek the expertise of experienced fraud defense attorneys like those at Arora Law.

What Is a Ponzi Scheme?

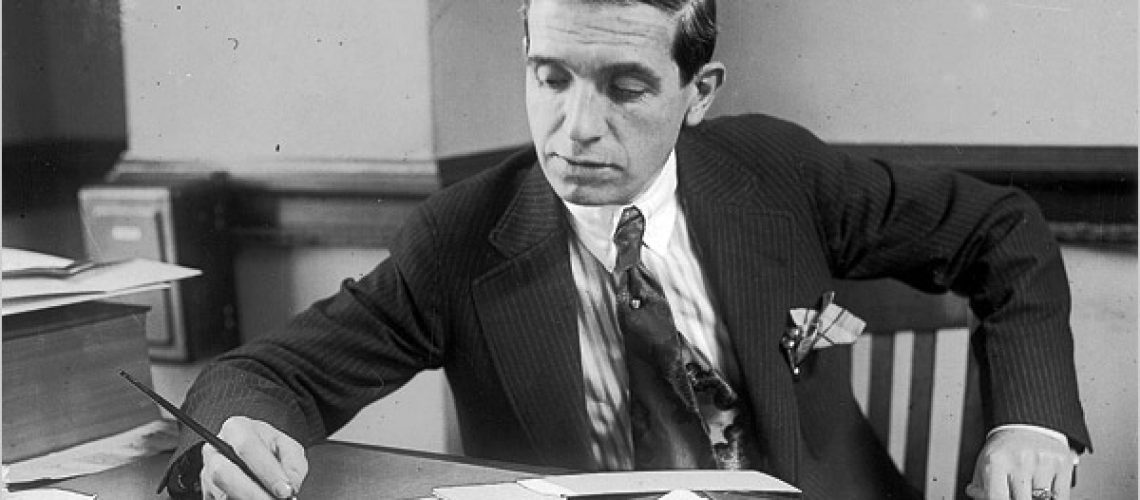

A Ponzi scheme is a type of investment fraud that lures investors through high returns with little to no risk. Named after Charles Ponzi, an infamous fraudster, Ponzi schemes operate by using funds from new investors to pay off earlier investors, creating the illusion of profitability. In reality, no legitimate investments or business activities generate the promised returns—ultimately, a lack of new investors leads to the inevitable collapse of the pyramid scheme from an inability to sustain payouts, resulting in financial losses for victims.

How Does a Ponzi Scheme Work?

Ponzi schemes rely on the trust and gullibility of investors. Here’s how they typically unfold:

- Baiting with Amazing Returns : The fraudster promises investors abnormally high returns—usually higher than what is offered by legitimate investments.This is often one of the first warning signs.

- Paying Early Investors: To build trust and attract more victims, the schemer pays early investors the promised returns using funds from new investors, creating the illusion of a successful investment.

- Attracting More Investors: Unbeknownst to them, the early investors aid in the expansion of the fraudster’s web of deception, encouraged by their returns to try to rope in family, friends and acquaintances.

- No Real Investments: Because the fraudster continues to use money received from new investors to pay earlier ones, this cycle only leads to no real investments with all returns solely funded by new victims.

- Scheme Collapse: Sustaining payouts becomes impossible with the decline of new investors. The scheme unravels, exposing the fraud and leaving many investors with significant financial losses and facing legal consequences.

Bernie Madoff’s PonziS cheme

One of the most notorious Ponzi schemes in history was orchestrated by Bernie Madoff. Over several decades, Madoff defrauded thousands of investors, including celebrities and prominent individuals, in a scheme that eventually unraveled in 2008. Madoff promised consistent, high returns and operated his fraudulent investment advisory business, falsifying records and using funds from new investors to pay off old ones. The collapse of his scheme resulted in massive financial losses totaling billions of dollars and led to Madoff’s conviction and imprisonment.

How to Avoid Ponzi Schemes

Protecting yourself from Ponzi schemes requires vigilance and due diligence. Here are some essential steps to avoid falling victim:

- Research and Verify: Thoroughly research all investment opportunities before committing funds. Verify the legitimacy of the investment, including the credentials of the individuals involved and their track record.

- Ask Questions: Ask detailed questions about the investment strategy, underlying assets, and the mechanism through which returns are generated. Legitimate investment professionals should be transparent and willing to provide satisfactory answers.

- Independently Verify Returns: Be skeptical of investment opportunities that promise consistently high returns without any associated risks. Consult with independent financial advisors to evaluate the legitimacy of the proposed returns.

- Diversify Your Investments: By placing your investments across different asset classes and advisors, you can reduce the risk of fraud by relying on a single individual or entity. .

- Trust Your Instincts: If an opportunity sounds too good to be true, walk away because it most likely is. It is better to miss out on a potentially fraudulent investment than to suffer financially and legally.

On the other hand, what do you do if you are accused of running a Ponzi scheme?

If you find yourself accused of running a Ponzi scheme, the situation can be overwhelming. Here are some crucial steps to take:

- Seek Legal Representation: Immediately consult with an experienced fraud defense attorney who specializes in handling complex financial cases for the expertise and guidance needed to navigate the legal process and protect your rights. Without a criminal defense lawyer, your chances at fighting charges can be diminished.

- Preserve Documentation: Gather and preserve all relevant documents, including financial records, transactions, and communication, as they are critical in building your defense.

- Cooperate with Authorities: Be cooperative with law enforcement agencies and provide necessary information through your legal representation. However, avoid making statements without consulting your Ponzi scheme lawyer first.

- Develop a Comprehensive Defense Strategy: Your attorney will analyze potential fraud charges and will analyze the evidence, identify weaknesses in the prosecution’s case, and develop a robust defense strategy tailored to your circumstances.

Possible Charges and Consequences

Being accused of running a Ponzi scheme can lead to a range of criminal charges, including:

- Securities fraud

- Wire fraud

- Mail fraud

- Money laundering

- Conspiracy

Convictions for these charges can result in severe consequences, such as substantial fines, lengthy jail time, restitution payments, forfeiture of assets, and irreversible damage to personal and professional reputations.

Why Hire Fraud Defense Attorneys in Georgia

When facing allegations of involvement in a Ponzi scheme, it is crucial to hire an experienced fraud lawyer in Georgia. Arora Law is a leading law firm with a team of skilled attorneys who specialize in fraud defense. Our expertise in white-collar crime and our in-depth understanding of the laws and regulations in Georgia enable us to provide you with the best possible defense.

If you find yourself entangled in a Ponzi scheme, the consequences can be life-changing. It is essential to act swiftly and seek legal representation from the trusted fraud defense attorneys at Arora Law. Here, we are committed to protecting your rights, preserving your reputation, and securing your future. We have the experience, knowledge, and dedication to guide you through this challenging situation. Give our criminal defense attorneys a call for a free consultation so we can work together to secure your defense against the devastating consequences of Ponzi scheme allegations.